StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Family Finance

Free

Family Finance - Assignment Example

Summary

Cash inflow refers to the earnings of the organization and cash outflow means the expenditures from the organization.Brad is working as a senior manager…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER95.7% of users find it useful

- Subject: Finance & Accounting

- Type: Assignment

- Level: College

- Pages: 4 (1000 words)

- Downloads: 0

- Author: istoltenberg

Extract of sample "Family Finance"

Family Finance Affiliation with more information about affiliation, research grants, conflict of interest and how to contact

Family Finance

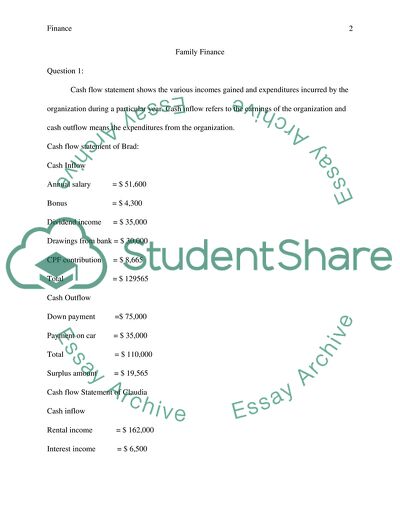

Question 1:

Cash flow statement shows the various incomes gained and expenditures incurred by the organization during a particular year. Cash inflow refers to the earnings of the organization and cash outflow means the expenditures from the organization.

Cash flow statement of Brad:

Cash Inflow

Annual salary = $ 51,600

Bonus = $ 4,300

Dividend income = $ 35,000

Drawings from bank = $ 30,000

CPF contribution = $ 8,665

Total = $ 129565

Cash Outflow

Down payment =$ 75,000

Payment on car = $ 35,000

Total = $ 110,000

Surplus amount = $ 19,565

Cash flow Statement of Claudia

Cash inflow

Rental income = $ 162,000

Interest income = $ 6,500

Withdraw from bank = $ 200,000

Interest on savings a/c= $ 200

Total $ 368700

Cash outflow

Down payment = $ 200,000

Total = $ 200,000

Surplus amount = $ 168,700

Brad is working as a senior manager who receives an annual income of $ 51,600. He has investment in banks and he received dividend of $ 35,000. During this year, he made a surplus earning compared to his outflow of cash. Claudia is a house wife and she earned a rental income of $ 162000 she got an interest of $6,500 on her deposit and $200 for savings deposit. During this year she had inflow of $368700 whereas, the cash outflow was $200,000 and the surplus amount is $168700.

Surplus amount refers to the balance amount after the total expenditure is deducted from total income. However, if the expenditures exceed income, then there will be a deficit. Surplus helps to meet contingencies in the future as well as to meet all anticipated expenditures in the future.

Net Worth:

Net Worth = Asset- Liabilities

Brad Net Worth

Asset

Spore equities = $350,000

CPF OA = $75,000

CPF SA =$35,000

Insurance = $9,600

Savings A/C = $ 30,000

Total = $ 594,600

Liabilities

West coast property = $ 250,000

Car loan = $ 95,000

Total = $ 345,000

594,600- 345,000 = $ 249600

Net worth = 249600

Claudia’s Net Worth

Asset

Fixed deposit = $200,000

Insurance = $6,500

Pine Grove condo = $ 860,000

Amber property = $ 950,000

Total = $ 2016500

Liabilities

Loss in investment = $ 70,000

Outstanding loan = $ 78,000

Total = $ 148,000

Net worth = asset- liabilities

$ 2016500-$ 148,000 = 1868500

The net worth amount of Claudia is greater as compared to Brad. As it can be seen, Claudia has more assets than Brad.

Brad Financial Ratio:

Liquidity Ratio = Current Asset/ Current Liability

39600/95000 = 0 .41

Liquid-Assets to Net worth Ratio

Liquid Assets to Net worth = Cash / near Cash divided by Net Worth

30,000 / 249600 = .12

Net Investment Assets to Net worth Ratio = Total Invested Assets divided by Net Worth

350,000 + 75000 + 35000/ 249600 = 1.84

Debt-to- Asset Ratio = Total Long Term Debts / Total Long Term Funds

250,000/ 350,000= 0.71

Claudia’s Financial Ratio:

Liquidity ratio = current asset/ current liability

6500+ 200+ 162000/ 78,000 = 2.1

Liquid-Assets to Net worth Ratio

Liquid Assets to Net worth = Cash / near Cash divided by Net Worth

200,000/1868500 = 0.10

Net Investment Assets to Net worth Ratio = Total Invested Assets divided by Net Worth

200,000 + 860,000 + 950,000 /1868500 = 1.07

Debt-to- Asset Ratio = Total Long Term Debts / Total Long Term Funds

78000/ 200,000+ 950,000+ 860,000 = 0.038

Question 2:

In Singapore, a working mother is entitled to get a tax relief as follows. She will get a tax relief of 15% for the first child, 20% for the second child and 25% for the third child. Suppose she earns an annual income of $ 75000 and she is liable to pay 6% tax, that mean she has to pay the following tax $ 75000*6/100= $ 4500. As a working mother, she is liable to pay only 4.5 % then her tax structure is as follows: $75000*4.5/100 = $ 3375.

In Singapore, the citizens can save $7000 on their tax amount to be paid on annual return. Suppose in the case of Claudia, she has to pay an amount of $10,000 as tax for her annual income. By utilizing parent’s tax she is entitled to get relief on her tax amount and she needs to pay only $3000 as tax instead of $10,000.

In Singapore, the maximum contribution to supplementary retirement scheme is 15%. “A Singaporean, Singapore permanent resident (SPR) or foreigner who earns any form of income (eg employment income including directors fees, trade income, rental income)” (Individuals: Foreigners, 2007, para. 1). One has to pay a maximum of up to 15% of their annual income in the SRS account. If Claudia has an annual return of $75000, then she can contribute to SRS 15%. According to this, SRS of Claudia will be as follows:

75000*15/100 = 11,250. As per this example, she can contribute about 11,250 on SRS account.

Question 3:

Claudia seeks your advice for the most effective way of planning to give her assets to the following beneficiaries:

i. Change properties ownership from Single Ownership to Joint Tenancy with her 3

Children

The most effective way of planning to change properties ownership from Single Ownership to Joint Tenancy with her 3 Children are by adopting Joint Tenancy with Right of Survivorship, Tenancy by the Entirety and Community Property with Right of Survivorship.

ii. Insurance Policies’ Proceeds to Brad and Javier

Insurance Policies’ Proceeds to Brad and Javier is best with whole life insurance.

iii. Saving Account to charity

Claudia and Brad have no systematic savings plan.

Question 4:

(4a) Step 1: to compute the Estimated Annual Retirement Expense amount at age 62. You need to first find the:

Present Value Annuity Due Factor at 23 years with adjusted rate of return of 2% i.e. (5% - 3%) is

Insurance of Brad = $ 9,600

Insurance of Claudia = $ 6,500

Insurance Premium = $1,820.00

5% of 9600= 480

3% of 9600= 288

So the Present Value Annuity Due Factor at 23 years with adjusted rate of return is

480-288 = 192.

The Estimated Required Retirement Amount at age 62 is = $1,935,026.00

The Estimated Annual Retirement Expense at age 62 is

$1,935,026.00/192 =10078.2604.

(4b) Step 2: To compute the Required Annual Retirement Expenses in today’s dollar, you have to first find the:

Future Value Factor after 13 years with an average rate of inflation of 3% is

$300,000*3%= 9000.

The Estimated Annual Retirement Expense at age 62 as derived above.

Annual Retirement Expense at age 62 is $83,065.00

The Required Annual Retirement Expenses in today’s dollar at age 49.

The Required Annual Retirement Expenses in today’s dollar at age 49 is $83,065.00/9000= 9.223.

Reference List

Individuals: Foreigners, (2007). Inland Revenue Authority of Singapore. Retrieved Oct. 12, 2011, from http://www.iras.gov.sg/irasHome/page04.aspx?id=6036

Read

More

sponsored ads

Save Your Time for More Important Things

Let us write or edit the assignment on your topic

"Family Finance"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY